Exclusives

Whip Media: Pandemic is Driving Dramatic Shifts in Consumer Behavior, Content Strategies

Story Highlights

The coronavirus era is fueling pandemic TV viewing and driving dramatic shifts in consumer behavior and content release strategies and windows, according to Whip Media Group.

With it, there is a unique opportunity to measure changes in viewing behavior, sentiment and the associated implications on programming choices, theatrical attendance, release windows and streaming services.

“We know TV viewership is up,” Alex von Krogh, VP of data sales at the company, said during a May 27 presentation at the Hollywood Innovation and Transformation Summit (HITS) Live event.

“There’s a lot of factors going into that” increase in viewership, he said during his presentation, “Connecting with Consumers with the Right Content During Massive Social Shifts.”

“Obviously in the age of COVID, we’ve got a remote workforce” for one thing, he said, explaining: “People are at home more, watching more content on their televisions, tablets, phones” and other devices.

“Meanwhile, there are more than 40 million Americans unemployed now, concerts and sports events are getting canceled, schools are closed, “theaters are completely shut down,” theatrical windows have been reduced or are now “non-existent, and all that has led to straight-to-home distribution for digital platforms,” he noted. So, the pandemic has presented “opportunities and challenges,” he said.

This all just begs the question: What do people want to watch? Therefore, the company did a study of its TV Time community of TV enthusiasts that it tracks across the globe to figure that out, he noted.

Not surprisingly, what they wanted to watch most was what’s on their Netflix queues and other watch lists, which “speaks to the value of library content” because most of what’s on the average person’s list are probably catalog titles rather than new releases “since you’ve been waiting to watch it a while,” he pointed out.

Many of those surveyed also indicated they wanted to watch content to “escape” from reality, laugh and find comfort, he said. Content relevant to what is happening today, such as COVID-19-related programming, was much further down on their lists, he said.

He was likely referring to the same survey conducted in mid-March of over 4,000 TV Time users that Carol Hanley, chief revenue and strategy officer at Whip Media Group, cited during an April webinar.

“The key for us is tapping into those emotions that we know people feel — digging deeper into them and then monitoring them and tracking them to understand what kind of content people want to watch and what’s behind that,” he explained.

The company also tracks viewers’ emotional responses to content and wanted to see if that changed over the past year, he told viewers of his presentation. What it found were “pretty substantial shifts in how people are feeling and responding,” moving from happiness to excitement and shock, he said. Consumer emotions were becoming “more nuanced,” with some happiness mixed with other emotions, and that “may have implications” for the content organizations may want to distribute now, he added.

COVID-19 is “really accelerating the demand” for content to “fill programming holes” and monetize content, he said.

He pointed to the case of the TV show “Tell Me a Story” that CBS All Access canceled after two seasons. The CW announced that it acquired the linear TV rights to both seasons for a “second-window run,” he noted. There are, after all, “pressures on filling air time because production is halted and there’s just not as much content as they would normally have,” so this show was “one of the pieces” to fill that air time, he explained, adding it proved to be an “appropriate acquisition” and “Swamp Thing” was also acquired by The CW and paired well with “Tell Me a Story.”

Global distribution is a “key piece of the puzzle in monetizing content,” according to Whip Media Group. Therefore, it is critical to understand regional demand for a piece of content to inform distribution and licensing strategies, von Krogh explained. A media company may or may not have deals in certain countries, he noted, adding: “If you do, this kind of data helps you renegotiate deals and get more dollars per episode.”

In the case of the show “Tell Me a Story,” Whip saw broad demand across Eastern European countries, he noted.

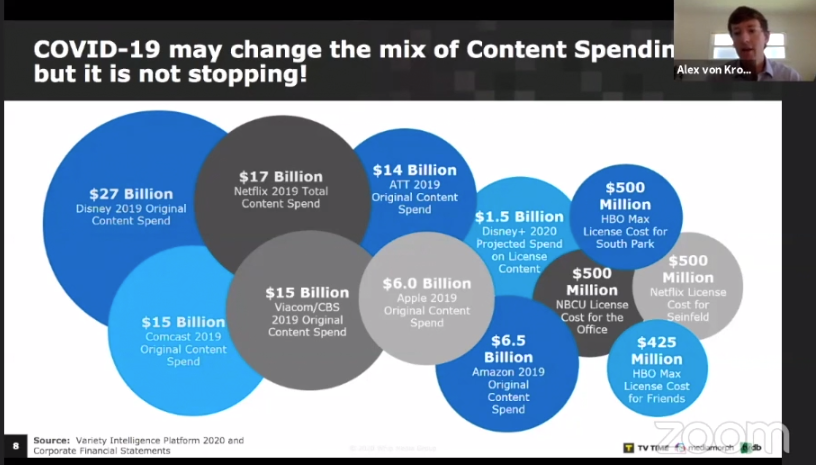

He concluded by pointing to the “massive amount of spending on content that we’re seeing today,” including original and library titles, adding: “That’s not going away.” He pointed to Apple’s recent announcement that it was branching out from original content to catalog films and TV shows. COVID-19 may change the mix of content spending, but it is not stopping, he said.

Click here for the presentation slide deck.

The May 27 HITS Live event tackled the quickly shifting IT needs of studios, networks and media service providers, along with how M&E vendors are stepping up to meet those needs. The all-live, virtual, global conference allowed for real-time Q&A, one-on-one chats with other attendees, and more.

HITS Live was presented by Microsoft Azure, with sponsorship by RSG Media, Signiant, Tape Ark, Whip Media Group, Zendesk, Eluvio, Sony, Avanade, 5th Kind, Tamr, EIDR and the Trusted Partner Network (TPN). The event is produced by the Media & Entertainment Services Alliance (MESA) and the Hollywood IT Society (HITS), in association with the Content Delivery & Security Association (CDSA) and the Smart Content Council.

For more information, click here.