HITS

M&E Journal: Small Is Beautiful and Profitable

Story Highlights

By Shubham Choudhury, M&E Consulting Lead, Cognizant –

2007 was a pivotal year for the M&E industry. Apple launched the iPhone. Netflix launched its streaming video service. Twitter wowed attendees at the SXSW conference.

In the ensuing decade, M&E industry segments have coalesced with the technology, social media and internet industries. The result? New mega-segments defined by the value they generate for consumers. The new players have one need in common: to calculate the smallest amount of content at which they can make a profit.

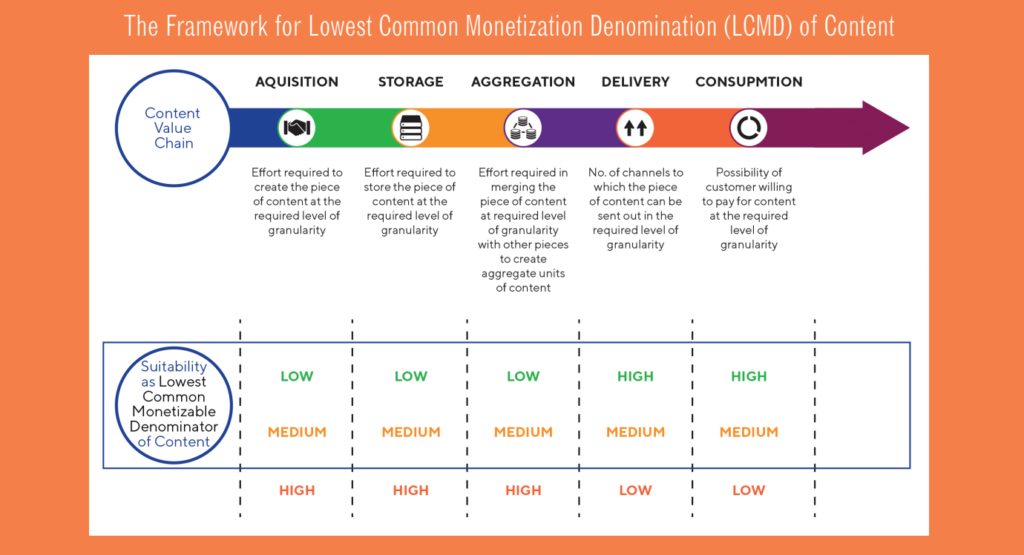

The Lowest Common Monetizable Denominator (LCMD) helps determine content that can be tracked, tagged, and reused. It’s part art, part science. But knowing your LCMD can help generate more dollars per unit of content. It will also expose content in granular chunks across multiple digital platforms and track returns per unit for making better investment decisions.

The new mega-segments in M&E

Content creators, curators and aggregators have emerged as industry mega-segments, and while each face unique challenges, all share the need to monetize content to the maximum extent.

Content creators generate and deliver the content that is their intellectual property. The majority of players are traditional and have long go-to-market timeframes. They’re working to ensure their business models keep up with the digital tidal waves.

Major challenges facing them include:

-Redefining legacy content value chains disrupted by digital.

-Supplementing declining traditional revenue streams with digital monetization models.

-Unbundling monolithic blocks of content to the lowest monetizable unit, making them more reusable and delivering them as-a-service

-Improving return per content asset by rationalizing the cost of operations and improving discoverability.

-Making content experiential through human- centric design.

-Redesigning product, platform, content and technology org structure to align with digital-first business strategy.

Content curators enhance and deliver third-party content. With shorter go-to-market timeframes, organizations in this segment are often more advanced in technology adoption. They’re trying to counter commoditization of their services by moving from information to insights.

Major challenges include:

-Reducing latency in content value chains by orders of magnitude.

-Making content ubiquitous through API-based automated utilities.

-Transforming content operations to deliver insights instead of information.

-Improving returns per content asset by better discoverability and reuse.

-Hyper-personalizing content by leveraging customer code halos.

-Ensuring content stays ahead of the technology curve.

Content aggregators provide experiences based on user-generated and third-party content. Most aggregators are digital natives. They operate at the bleeding edge of technology and business model innovation.

Content aggregators provide experiences based on user-generated and third-party content. Most aggregators are digital natives. They operate at the bleeding edge of technology and business model innovation.

They want to own the last-mile customer experience and leverage the vast amounts of customer data they collect for more value.

Major drivers include:

-Hyper-personalizing content by leveraging customer code halos.

-Increasing revenues per content asset by targeted ad generation.

-Operationalizing user experience platforms based on content.

-Proactively addressing increasing privacy and security concerns.

-Ensuring greater authenticity and accuracy of content.

How to calculate your LCMD

As digital platforms proliferate, the monetization potential of content per platform is expected to drop. Identifying the smallest unit of content that can be stored independently and delivered profitably across platforms will be a key differentiator.

How do you spot an LCMD? By evaluating pieces of content based on parameters at various points of content activities (see diagram ). The objective is to strike a balance between minimizing the effort to create, enrich, and deliver content, and maximizing its re-usability, exposure, and value.

If the values of all content parameters fall within the section highlighted in the diagram, the content is a good fit for LCMD consideration. There’s also flexibility for companies to determine the factors that best align with their requirements and constraints.

For example, an organization may be willing to devote a lot of effort to acquiring content at the LCMD level if the number of delivery channels and the profitability potential correspond. Assigning weights to each parameter can help determine a score for identifying the LCMD. If content at its current level of granularity doesn’t fall within the parameters above, the company should consider higher or lower levels to determine the best fit.

Storing content at the LCMD level provides organizations with several competitive advantages:

-Delivers content packages to customers by aggregating or breaking down content into smaller pieces leveraging semantics.

-Makes content more discoverable when tagged with the right metadata.

-Improves reusability of content across products.

-Exposes units of content to greater number of channels.

-Identifies the returns on content at a granular level and helps make more accurate investment decisions.

Guidelines to keep in mind when determining LCMD

Assign unique identifiers. Each piece of content at the LCMD level requires a unique identifier to be meaningfully utilized.

-Parameters are flexible. While the parameters in the diagram appear in the order in which they fit in the content value chain, companies can evaluate the factors in any order. For example, a company may want to evaluate delivery channels first if the lowest level at which content can be stored depends primarily on those channels.

-Changes in technology and business strategy can impact content granularity. An education outcome provider might consider a textbook as an LCMD at one point of time, and later break it into individual lessons and leverage them as LCMD.

-Different types of content and formats have different LCMDs. For example, text content is monetized at one level of granularity, multimedia content at another. Similarly, the latest news items can be monetized at the headline or video-clip level. Editorials can only be monetized at the composite level.

-Consider management of associated rights and royalties when identifying an LCMD of content. For example, will monetizing individual episodes of a serial drama separately have an impact on residuals payments. Over the last decade, most organizations have been continuously refining their content value chains to keep pace with digital change.

The idea of LCMD is expected to evolve along with the value chain. Digital native companies are better positioned to leverage LCMD than traditional players as their content value chains have been built ground up with an eye toward multi-platform monetization, data-driven insights and enhanced discoverability.

As the API economy drives greater dissemination of content across digital platforms, all organizations will be able to create more accurate models for identifying their LCMD of content.

—-

Click here to translate this article

Click here to download the complete .PDF version of this article

Click here to download the entire Spring/Summer 2018 M&E Journal