Exclusives

M&E Journal: Real-Time Actionable Analytics: A Game Changer for Broadcast TV

Story Highlights

By Simon Trudelle, Senior Product Marketing Director, NAGRA –

We live in a world where information is king, and the M&E industry is no exception. However, there are certain markets, such as broadcast television, that have been slow to adapt to this new “data-driven” world.

While data capture at the set-top box level has been a technical reality for more than 15 years, few operators have been able to tap into the potential that usable data and insights can make possible. This creates a significant challenge in a world where companies, such as Netflix, built their success on the ability to capture, analyze and act on usage and network data in real time.

The industry has invested in data analytics tools and systems over the years, but their focus has proven to be vertical, by department and function, addressing important yet specific challenges like churn reduction or network failure. This has created silos between various business units, such as marketing, sales, IT, R&D and operations, which prevent service providers from adapting to a fast-changing environment.

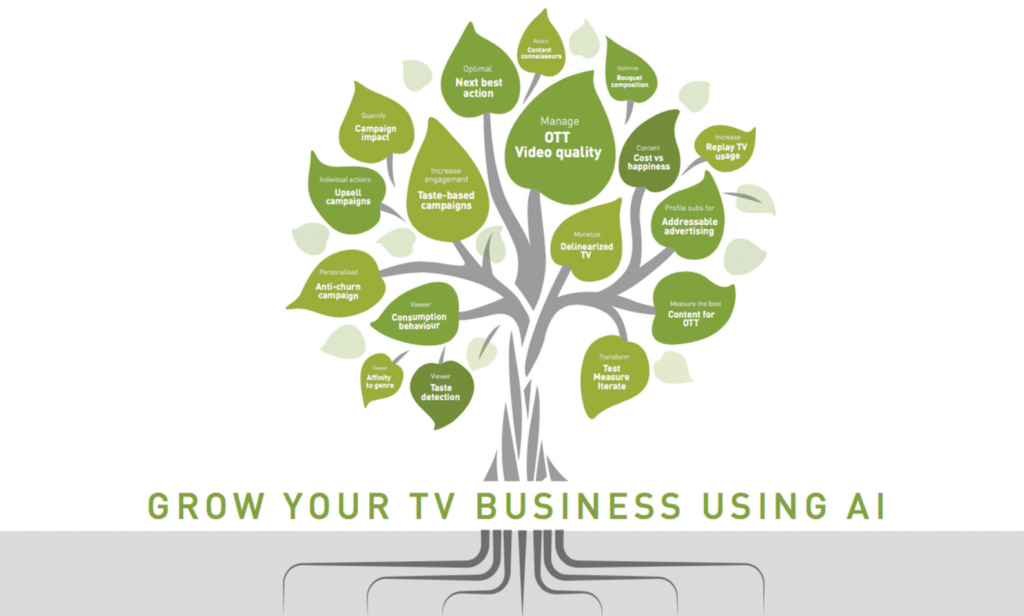

Smart AI-based analytics and cloud technology are the solution. When optimized, it is possible to leverage analytics to understand viewership as well as viewer behavior and interests by easily capturing data from different sources and rapidly finding unique correlations. This is a big game changer for the industry.

To tap into the full potential of actionable analytics, four considerations must be addressed.

The secret to success is quality over quantity

Like in the physical retail world, analyzing ticket counter sales might give you market share, but understanding the buyer’s journey is what now matters in a much more competitive TV and video industry. Knowing the “why” of people’s decision to buy one product over another one and how much affinity they have with the brands and stores where they buy it from is where the real business value comes to life.

Successful operators and broadcasters are shifting their mindset from working to collect “all the data they can” (big data) to “just the data needed to make smart decisions” (smart data). Capturing data for every video consumption point may be something that some internet giants are getting close to achieving. The reality, however, is that emerging AI-based analytics systems can only work with a relevant subset of data and deliver the expected value, within an acceptable confidence interval.

When it comes to data collection, capturing behavior on the STB and big screen remains a challenge as multiple users are often interacting with the system at once. Automated behavior analysis can help again reduce uncertainty, however. In addition, pay-TV players are looking to non-traditional sources for their quality data. From pirate usage data to social media comments on content, this information matters more and more to understand consumer appetite for content.

The right analytics platform can look at both pirate sites and social media to address that very question.

Starting with massive data collection is never the right approach. When services providers start with the business questions that are most important to their unique situation, then they can determine the best data needed to address those needs. Then the analytics will give the information needed to determine the best action to drive results.

Priority 1 is making better business decisions

Priority 1 is making better business decisions

When it comes to pay TV schedules, content promotions, commissioning and other business decisions, leveraging analytics is key to improving broadcast channel offerings. It can, in fact, can provide better accuracy than traditional statistical survey methods.

Audience measurement is only useful to drive the pay TV business forward if it delivers actionable insights – data that can be used to improve QoS, user experience and recommendations, advertising, content acquisition or churn reduction. Otherwise, one could argue that Nielsen-style consumer surveys were as good as the extensive “dynamic” channel usage reports that channels and operators get nowadays from basic “data analytics tools.”

Connecting viewing data to other data sets that can help understand the consumer behavior is a holistic way to turn raw data into actionable intelligence. Pay TV operators can then predict the next “right action” for the viewer. When this is possible, the industry will shift from the mindset of “what the viewer wants to watch next” to “what content to commission, program or acquire” to match needs.

This data-driven AI can help understand consumer interests, but it is not going to replace human talent to dream, design and develop innovative new stories and shows. Knowing that, there is a part of intuition and innovation that must be part of the decision mix. Data analytics can help reduce risks and improve the accuracy of the predictions marketers must make, so that content investments end up delivering a higher ROI with lower volatility.

Consumer privacy and data accessibility challenges

The irony with data is that while consumers feel it is fair to let Facebook or Google know everything about their profiles, preferences, affinities and whereabouts, because it helps them get a better “free” service, the perception is very different with “paid” services.

This is where Apple or Amazon, for instance, have managed to overcome that perception barrier by creating a “halo effect” around theirs brand, products and services, supported by an outstanding consumer experience. Therefore, paying and sharing data is acceptable because the overall outcome is beneficial to the user. This sets the bar high for pay TV providers and broadcasters, yet it shows the new requirements for capturing and monetizing data for service providers that operate behind a pay wall.

Pay TV operators must play in that league to stay competitive, improving their products, consumer relationships and brand image, and then become legitimate data collectors for consumers. When this happens, they will be able to seamlessly collect data and prove the added value they can provide. This is not an overnight game, but it starts with the right vision and needs to be followed by concrete consumer-focused actions over time.

Expanding relationships for evolving business models

With actionable insights that impact business decisions, cross-channel platform relationships become an important part of the equation. These relationships will be under stress going forward if the traditional licensing model does not change. However, both can win if they see data as a “new currency” that allows the whole ecosystem to be stronger, and manage data sharing efficiently. It’s a bold move to make, but like the content and rights owners going direct-to-consumer, it is an inevitable move in the short term.

Again, referencing the physical retail industry, access to data and data exchanges started to be part of the brand and distributor commercial relationships more than 20 years ago. As TV and video become consumer goods, driven by the understanding of consumer behavior, as an industry we must start moving in that direction to remain competitive.

Relying on a business-focused data analytics platform that securely collects relevant data, applies advanced algorithms and feeds the resulting predictions and insights into business operations systems will become key to success.

—-

Click here to translate this article

Click here to download the complete .PDF version of this article

Click here to download the entire Spring/Summer 2018 M&E Journal