M+E Daily

Analyst Upbeat on Sony CEO Transition Plan, Q3 Results

Story Highlights

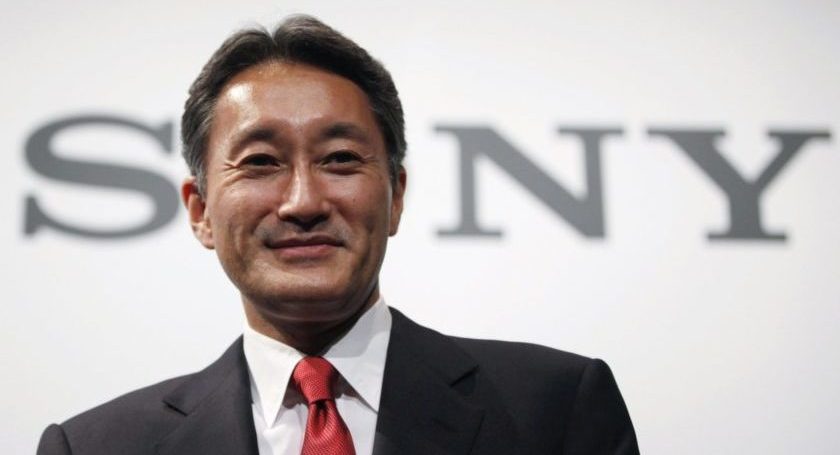

There were several “positive” takeaways from Sony’s recent announcement that its CEO, Kazuo Hirai, will soon be replaced in that role by its current CFO, Kenichiro Yoshida, as well as the results that the company announced for its third quarter (ended Dec. 31), according to Bank of America Merrill Lynch analyst Mikio Hirakawa.

“The fact that CFO Kenichiro Yoshida — who is fully cognizant of Sony’s current issues — is willing to take on the role of CEO most likely means that he already has an idea about how Sony can achieve further growth,” Hirakawa said in a research note Feb. 5.

Yoshida will become the company’s new CEO and Hirai will shift to Sony chairman April 1 as part of a new management structure announced by the company Feb. 2. The transition was “proposed by Mr. Hirai to the Sony Nominating Committee, and following deliberation by the Nominating Committee, was approved by the Sony Board of Directors at a Board meeting held earlier” the same day, the company said in a news release.

Hirai had been “dedicated … to transforming the company and enhancing its profitability, and am very proud that now, in the third and final year of our current mid-range corporate plan, we are expecting to exceed our financial targets,” he said in a prepared statement. “As the company approaches a crucial juncture, when we will embark on a new mid-range plan, I consider this to be the ideal time to pass the baton of leadership to new management, for the future of Sony and also for myself to embark on a new chapter in my life,” he said.

Sony’s Q3 results and revised forecast for the fiscal year, which “significantly exceed consensus estimates, suggest improvement in Sony’s profit-generating capabilities far above what the market envisaged,” Hirakawa said in his research note. The Q3 results also “confirmed steady growth in focal businesses” of Sony, including a margin of 26% on sensors, 37% year-over-year growth in streaming sales and 41% growth in video game and network sales, he said.

Sony’s combined Q3 sales and operating revenue grew to 2.7 trillion yen ($23.6 billion) from 2.4 trillion yen a year earlier, while profit soared to 295.9 billion yen ($2.6 billion) from 19.6 billion yen. Game & Network Services revenue increased 100.3% to 718 billion yen, while music revenue grew 39.9% to 218.4 billion yen, theatrical movie sales increased 35.2% to 260.3 billion yen and Home Entertainment & Sound revenue soared 76.4% to 429.8 billion yen.

Cumulative sales volume through 2017 for Sony’s PlayStation (PS) 4 video game console reached 73.6 million units, while subscription service PS Plus subscriber numbers totaled 31.5 million, Hirakawa pointed out.

“We expect smaller waves in the PlayStation 4 game console cycle due to growth in PS4 cumulative sales volume, growth in PS Plus subscriber numbers and the launch of an upgraded version” of the console, the PS4 Pro, he said, adding that, “after a peak in sales volume for the PlayStation 2 console, which was a major hit the equal of PlayStation 4, software sales remained at a high level.” PS2 software sales “peaked two years after the console sales peaked,” so if “we apply this example, PlayStation 4 software sales should continue to grow” until the third quarter of Sony’s 2019 fiscal year because console sales peaked in the third quarter of its fiscal 2017 (the current year), he said.

The Q3 results also “looked very good” to Wedbush Securities analyst Michael Pachter, he told the Media & Entertainment Services Alliance (MESA) Feb. 5. But he said he was “confused” by the Sony management changes because he “thought Sony was doing well,” adding: “I don’t think Kaz is too old, thought he was quite highly regarded, and thought he was an effective leader.”