Connections

M&E Journal: A Nuanced Approach to a Powerhouse Consumer Base

Story Highlights

By Greg Boyer, Partner, U.S. Entertainment and Media Advisory Practice, PwC –

You know which language feels right…” This boldly stated voice-over resonates in Xfinity’s latest commercial promoting the X1 platform and the associated bi-lingual remote control. In just 30 seconds, the spot captures the complexity of multi-generational, multi-lingual households that seek entertaining and relevant video programming. What is not captured in the commercial: how to create the content that will speak to this mixed audience.

Imagine you’ve been challenged with launching a new media and entertainment property. What’s your platform? What’s your target audience? How will you connect with your consumer?

Let’s start with the latter. At 55 million strong, the Hispanic population is the largest ethnic or racial minority in the United States. That 17 percent of the U.S. population is forecast to approach 30 percent by 2060.

Compounding that, a Q3 2016 PwC study, Always Connected: U.S.-based Hispanic Consumers Dominate Mobile, Entertainment, and Beyond, reveals Hispanic consumers are more prolific adopters of new technology than their non-Hispanic peers (i.e., tablets 63 percent to 56 percent, connected devices 37percent to 30 percent). Diving deeper, 47 percent of Hispanic consumers surveyed stream mobile video more than once per day. That far outpaces the 35 percent of non-Hispanic consumers polled. So, not only are Hispanic consumers adopting the latest technology—with video consumption as a proxy—they are also using the technology more aggressively.

While U.S. Hispanic consumers represent a growing market of media hungry, social influencers with increasing spending power, effectively engaging them has proven elusive to even the most committed companies.

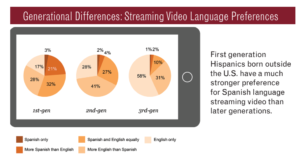

To illustrate the difficulty of appealing to this consumer base, consider the effect of generational differences. First-generation Hispanics born outside the U.S. interact with media differently in meaningful ways than third-generation, U.S.-born Hispanics.

No one-size approach

The simple answer is not always the right answer. Fifteen years ago, the primary way to watch video was at home on a television set in the living room. Now, consumers have a plethora of choices regarding what, when, where and how they watch content. Today, smartphones are omnipresent—over three-quarters of respondents in the most recent PwC Video-quake report say they watch video on their smartphones. The numbers for young Latino viewers are even higher. While entertainment for Hispanic consumers is a priority across segments, when determining the approach to reach the audience, one size does not fit all. Consider the levers at play: generation, language (English or Spanish), origin of birth, and the nuances of authenticity, relevance and appropriateness in cultural references.

Many terms have attempted to embody the complexity of the Hispanic consumer, including ‘ambicuturals’ and ‘billennials,’ which start to capture the idea that the simple box of ‘Hispanic viewers’ is no longer sufficient to use when building a strategy.

A recent PwC report found that cultural relevance and references may be more important than language alone. For example, take Martine, a Hispanic viewer: She is a third-generation, bilingual millennial with Colombian roots. She may not connect with content in Spanish or telenovelas or cultural references to Mexico. Instead, her favorite show may be an internet-grown comedy based in Jackson Heights, N.Y. However, at home, she enjoys hanging out with her parents and grandparents, and watching their favorite telenovelas. Even though she can speak Spanish, the colloquialisms that make her parents laugh go right over her head.

Regardless of language, however, entertainment is a priority. That is the one consistent finding. M&E companies need to understand that one size does not fit all, and the choice is not necessarily binary, either. This nuanced reality in the marketplace plays itself out property-by-property: it’s all about a strategy and execution.

Committed strategy and execution

Committed strategy and execution

Back to the theoretical challenge mentioned earlier of launching a new media and entertainment property: What would be your play across the Hispanic consumer base?

Media giants: Telemundo and Univision are institutions—33 and 55 years old, respectively—whose similar programming philosophies focus on sports, news, entertainment, and of course, telenovelas. The staple genre of the telenovela is a type of soap opera, but limited in episodes so that they span a year or less. Prime-time is the standard home for new telenovelas, which sometimes air live, while reruns air in daytime.

How important are telenovelas to these programmers’ identities? In the late 1990s, amidst a rating decline, Telemundo drastically overhauled its prime-time lineup by moving telenovelas to mornings and replacing them with U.S.-produced sitcoms, dramas, game shows and movies. Its prime-time share of the Latino audience plunged to 8 percent while Univision’s skyrocketed to 91 percent. Its audience, instead of adapting to new programming, went to a place they knew they could get what they wanted. Telemundo tinkered with its audience’s sense of culture, either underestimating or overlooking the nuance at play. That programming experiment was short-lived.

In today’s television landscape, the barriers to entry to compete against these giants are enormous. However, with the opportunity so inviting, the traditional media giants have all swept in, with varying degrees of success.

Five short years ago, Fox co-launched MundoFox with RCN TV Group of Colombia. It appeared to make perfect sense, since in the 1980s the Fox Broadcasting Co. became the fourth major U.S. network, taking the establishment by storm in carving out its own unique niche. MundoFox executives sought the Fox mold to pour into its budding network. To set it apart from the competition, it would create American-style programming in Spanish. However, its mix of news, entertainment and action-oriented storylines didn’t appeal to viewers, despite an increase in production costs. Furthermore, the network did not air telenovelas in primetime.

The risky programming strategy didn’t speak to a specific audience and failed to attract viewers. In three shorts years, Fox pulled out of the partnership, the network was rebranded MundoMax, the entire news department was let go, and eight hours of infomercials played daily. In November 2016, the network shut down.

It’s questionable whether MundoFox knew exactly who it was targeting. In contrast, Telemundo knew its audience well, but took a risk anyway. In the end, Telemundo had built up enough equity with its audience to recover from its programming misstep; MundoFox did not have that luxury.

New Entrants: Estrella TV’s relentless focus on a single target audience—young, U.S.-born Hispanics—is driving a remarkable success story.

Established in 2009, the network’s original programming was a far cry from the telenovela, and the rapidly-growing Hispanic millennial consumer base came in droves. Competing against the pillars of Univision and Telemundo, Estrella TV—the only Hispanic-owned Spanish television network in the U.S.—understood the sensitivities at play and recognized it could do a better job of understanding and appealing to the Hispanic community. To fill that purpose, in 2014 Liberman Broadcasting, owner of Estrella TV, hired former Los Angeles mayor Antonio Villaraigosa as a senior advisor.

To ensure Estrella showcased content that fit its brand and vision, it launched its own production company, Fenomeno Studios, which created a dynamic, multi-platform content ecosystem. The goal of this grassroots operation was to feature up and coming talent with popular social media presences in millennial-focused content—music, DIY, lifestyle—on digital platforms with the intention of breeding this talent for television.

Estrella TV took cultural relevance and authenticity to a new level. The network’s dedication to understanding its audience underscores the network’s 20 percent year-over-year growth in Nielsen primetime ratings among millennials during the summer of 2016. That’s in sharp contrast to the double-digit ratings drop seen by some of the powerhouse networks over the same time (Telemundo: -12 percent, Univision: -16 percent, UniMas: -8 percent).

Estrella TV proved within the Hispanic media landscape that there was an alternate path to success. Understanding its core demographic and creating a programming strategy just for that audience were primary ingredients in its recipe for success.

The investment and infrastructure required to compete at a network level aren’t necessary to reach the young Hispanic consumer base. In 2012, three seasoned TV veterans leveraged data, analytics and technology to create a You- Tube channel. That’s right—something anyone can do. One year ago, that YouTube Channel picked up $27 million in funding—a testament to the growing need for alternative programming in this space.

MiTu is a digital media network that offers lifestyle programming in both English and Spanish that Hispanic millennials are devouring. Within a year of launch, it surpassed one billion views and today delivers two billion monthly video views across platforms that include You- Tube and Facebook.

MiTu CRO Charlie Echeverry traces the platform’s success “to three strategic bets: one, to reach American youth, brands need to start by speaking to young Latinos; two, English is their language of preference; and three, social platforms are where the audience predominates, not TV.”

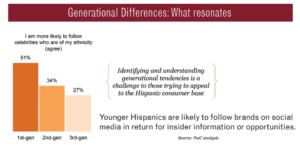

Let’s deconstruct that quote into its three parts. Speaking to young Latinos is a hallmark of this new PwC research–as the Hispanic population profile morphs into the future, the third generation is gaining ground in media consumption and purchasing power. So, get in good and early with them—build equity.

Secondly, English is their language of preference, but notice Echeverry said preference, not choice. The versatility of a digital offering is essential to its success–it can offer both English and Spanish content authentically, and with much more ease than a network.

Finally, Echeverry didn’t just target social media, he also specifically renounced TV. From a marketing perspective, if social platforms are the gold standard, then Hispanic consumers on social media are the Holy Grail. For example, Hispanic consumers visit 10 of 13 leading social media sites more often than their non-Hispanic peers. Additionally, 51 percent of Hispanic consumers say they use Snapchat to stay connected with family, according to the Hispanic Millennial Project—20 percent more than any other millennial cohort.

Finally, Echeverry didn’t just target social media, he also specifically renounced TV. From a marketing perspective, if social platforms are the gold standard, then Hispanic consumers on social media are the Holy Grail. For example, Hispanic consumers visit 10 of 13 leading social media sites more often than their non-Hispanic peers. Additionally, 51 percent of Hispanic consumers say they use Snapchat to stay connected with family, according to the Hispanic Millennial Project—20 percent more than any other millennial cohort.

Thirty percent of Hispanic millennials (versus 19 percent of non-Hispanic millennials) get their news from Instagram at least once a day. Finally, where the real advertising money lies: younger Hispanic consumers aged 18 to 24 (33 percent) are significantly more likely than their non-Hispanic peers (21 percent) to tweet, like, share, or follow a brand on social media in return for exclusive access to insider information about a new product launch or special appearance.

The beauty of this data is that it is platform agnostic. However, the data is true and it is real and the consumer base can embrace you or just as easily turn its back. While there is great opportunity with the Hispanic consumer base, multi-dimensional segmentation and an unwavering strategy are paramount in acquiring and maintaining an audience.

To that end, there are many ways properties looking to attract alternate audiences can do so. Univision might be the 55-year-old elder statesman of Spanish-language programming, but it also has its eyes set on Hispanic millennials, as evidenced in three recently-launched sister platforms. Fusion TV and El Rey are both English-speaking networks with strong digital presences, while Flama is an English-speaking digital platform that Univision admittedly used to experiment with alternate programming tactics in attracting young audiences.

Bringing it home

The Xfinity commercial referenced at the beginning of this article goes beyond recognizing the reality of needing to speak to Hispanic consumers across multiple generations. What we can really take from the commercial is that consumers know what they want and have innumerable ways to access it.

To succeed in this new landscape, distributors must embrace and showcase the expansive options of available programming. Advertisers must leverage the hyper-targeting opportunity of niche programming and provide authentic ads to their potential customers. Content creators need to take time to listen to the audience, understand and respect the nuanced segmentation, then adapt to the changing environment to produce the programming that will resonate with their viewers. These requirements hold true, no matter the audience or the platform you choose.

—-

Click here to translate this article

Click here to download the complete .PDF version of this article

Click here to download the entire Spring 2017 M&E Journal