Connections

Is Premium VOD the Death of the Movie Theater? Not so Fast …

Story Highlights

By Natasha Carter, Vistex –

Digital is king. OTT is the way to go. Mobile is the future! That’s what everyone is saying at least. If that’s true, does this mean the theater-going experience is dead?

You wouldn’t think so. With a record $11.4 billion in domestic box office revenues, reported by comScore in 2016, the film business should be rock solid. Twenty-eight films passed the $100 million tier in total earnings in 2016, versus 27 in 2015, and eight films grossed more than $100 million in their opening weekend, while only six achieved that mark in 2015.

As of April, box office revenues for 2017 were 6% higher than in 2016, and could set this year up to be the biggest revenue-generating year in North American box office history.

But there’s still cause for theater owners to be worried. Studios have long struggled with declining home entertainment sales, which fell from $24.9 billion in 2004 to $12.5 billion in 2016. And they need to recoup those losses somehow. Major studios like Fox and Warner Bros (which hold 13% and 17% of the market share, respectively) have indicated their interest in offering movies on TV during what has been historically the theaters’ 90-day premium window as a possible additional revenue stream.

Naturally, theater owners are concerned. Patrick Corcoran of the National Association of Theater Owners (NATO) said that their main issues center around the “price studios would charge home viewers, how much exhibitors would be paid, and the length of the lower priced window.”

So, are theaters filled with the inexplicably intoxicating aroma of buttered popcorn a thing of the past? No, and with recent box office highs, they aren’t going to be a relic anytime soon. But that doesn’t mean they are safe either. Studios are hopping on the bandwagon, as they realize the TV ecosystem and broadband/mobile landscapes are evolving. And if they haven’t yet, they soon will be.

Ampere Analysis reported that pay TV as a whole reached $204 billion in 2016, and passed TV advertising as the biggest source of funding. They also project that by 2021, OTT subscriptions in the U.S. and Western Europe will surpass traditional pay subscriptions as the way to watch TV.

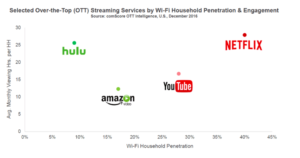

comScore reports that while Live TV still dominates the market, OTT isn’t terribly far behind. Both Hulu and Netflix lead the way in monthly viewing hours, while Netflix and YouTube have penetrated more of the market. This, in part, has to do with the type of content OTT services are delivering.

The Wit, which helps producers, broadcasters, distributors and advertisers dissect the ins and outs of the industry, reported that the number of new scripted shows launched in 16 markets and calculated “extra territorial” drama titles from Netflix, Amazon, Hulu, and YouTube Red shot up 110%, from 31 in 2015 to 65 in 2016.

Combine that with the FCC’s initiatives to encourage broadband internet providers to provide higher speed product offerings in underserved areas of the rural U.S., and that is bound to upset the balance of the current industry climate.

Combine that with the FCC’s initiatives to encourage broadband internet providers to provide higher speed product offerings in underserved areas of the rural U.S., and that is bound to upset the balance of the current industry climate.

The rise and rise of digital platforms can’t be ignored. More and more companies are popping up, hoping to capitalize on our addiction to content. There is an eventual OTT platform coming out of the newly created Oath Division of Verizon, which already has FiOS TV and their mobile app, Go90. Blackpills is a digital media company that creates short-form content via an app that is free to download.

The app targets millennials who grew up in a binge worthy culture and aims to air new shows each week. Then there is Premium Platform Japan, a new investment with six of the most prominent media companies in Japan, including broadcaster TBS and newspaper publisher Nikkei.

Is digital changing things? Yes. In the future, will we all watch the newest blockbuster on our couch? Maybe. At the end of the day, it boils down to how consumers want to ingest content. Movie theater viewing isn’t dead any more than mobile is the singular choice for viewing consumption. Die-hard movie fans don’t mind spending the extra money for the experience, while there are others who prefer viewing from the comfort of their own home or on the go. But one thing is certain: consumers like options, and that trend is not likely to change.

—

Natasha Carter is the global marketing manager for Vistex, a provider of software solutions to the media and entertainment industries. Vistex partners with studios, distributors, broadcasters, and operators to effectively manage, automate and simplify the most complicated processes. Vistex solutions allow clients to manage their entire workflow; from contract negotiations all the way through rights management, integration with broadcast scheduling systems, avails reporting and the protection of their content. Vistex ensures that monies due or owed are properly calculated and administered.

Click here to learn more.