M+E Connections

Amazon CFO: Company to Continue Investing Heavily in Prime Video

Story Highlights

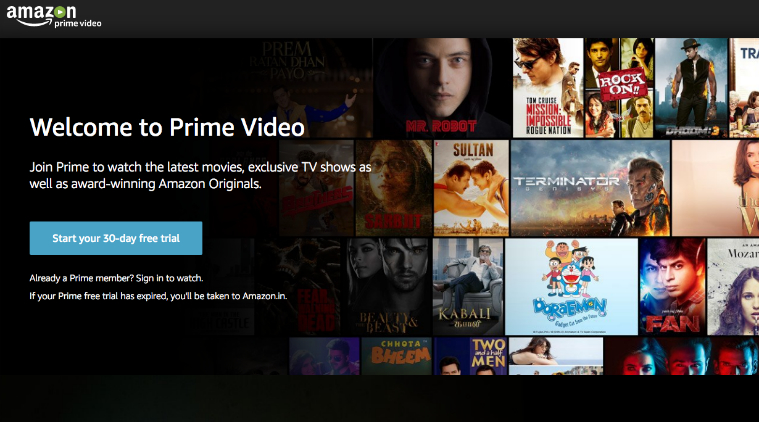

Amazon liked what it saw with customer engagement and its Prime Video service in the fiscal year and fourth quarter (ended Dec. 31), and will continue investing heavily in the service, according to Amazon CFO Brian Olsavsky.

The company saw a “doubling” of Prime video usage hours in 2016 and “our customers have responded really well to the shows that we’ve created,” he said on an earnings call Feb. 2. At the same time, Amazon is pleased with the studios and other content partners it’s been able to work with for the video service, he told analysts.

Amazon expanded Prime Video globally to more than 200 countries in December. Partially as a result of that, Amazon’s investment in video “did step up in the second half of last year, including marketing — and that will continue in 2017 and likely beyond,” Olsavsky said. Original content for Prime Video is a “fixed cost expense” now, he also said, adding: “The more we can amortize it over a large base, the better off we’ll be.”

But Amazon shares were down 3.04% at $814.49 in early afternoon trading Feb. 3, at least in part because revenue came in somewhat lower than analysts had projected.

Although Amazon revenue was “a bit light of consensus” analysts’ estimates, Baird Equity Research analyst Colin Sebastian said in a Feb. 3 research note that gross margin and consolidated segment operating income were higher than his estimates, “largely due to favorable segment mix” and margin expansion in the company’s Amazon Web Services cloud business.

Sales continued to grow in Amazon Web Services during the fourth quarter, increasing to $3.5 billion from $2.4 billion a year earlier. But analysts had been expecting somewhat stronger growth than that.

At least some of the slower-than-expected growth in Amazon Web Services revenue can be chalked up to the seven price cuts that Olsavsky said Amazon made in its cloud service offerings in the fourth quarter. “About a third of the impact” from the price cutting “was seen in Q4,” he said, but added: “That’s going to be constant in this business. We’ve been pretty clear that this business is all about creating new functionality for customers, giving price cuts and then working on the operating efficiencies.” Therefore, Amazon was “very pleased with Q4 and the pace of the business,” he said, noting that new services and features last year totaled more than 1,000 versus 700 in 2015. “So, we continue to innovate on behalf of customers,” he said, pointing out that large customers now include Salesforce.

Amazon also continues to invest heavily in its artificial intelligence (AI)-driven Alexa Voice Service that’s featured in several devices by the company and now third-party manufacturers as well. Those products include the Amazon Echo, one of the top-selling products this past holiday season.

Amazon also added Alexa capabilities to its tablets and Fire TV devices, which Olsavsky said “make the devices better and [also] builds engagement — not only with Echo and Alexa, but also with Amazon.”

“We’ve added 4,000 skills to Alexa since I last spoke to you in October and we’re working with a lot of major companies as they add abilities, too, for our customer base,” he told analysts. He added that “tens of thousands of developers are building new skills for Alexa, so the skills addition should continue, and — just as importantly — tens of thousands of developers are also using the Alexa Voice Service to help integrate Alexa into their products, which then creates a great network effect.”

It was “still very early days,” he said, when asked to quantify retail sales through Echo devices. Therefore, “that’s not material,” he said, but added: “The engagement is just like any other Prime benefit or investment that we have. We do look at engagement and we like the engagement of customers who have Echoes.” He went on to say that holiday season unit sales of Echo devices were nine times greater than they were a year earlier.

Although the $33.25 billion-$35.75 billion (14-23% growth) first-quarter forecast that Amazon provided was lower than what analysts had expected, RBC Capital Markets analyst Mark Mahaney said in a Feb. 3 research note that the projection “implies very consistent growth” for the company. Amazon’s wide $250 million-$900 million operating income estimate, meanwhile, was also lower than what analysts had expected and weaker than the $1.1 billion operating profit Amazon reported for its prior Q1. But Mahaney said Amazon’s guidance “reflects ongoing investment” in video, Alexa, its expansion in India and other areas of the company’s business.

Wedbush Securities analyst Michael Pachter said in a research note that he expected Amazon to “continue delivering substantial earnings growth.”