Exclusives

M&E Journal: Evolving Business Cases in the EIDR Growth Path

Story Highlights

By Don Dulchinos, Executive Director, Entertainment ID Registry –

The EIDR registry has grown in many dimensions. The raw size of the registry has grown to over 840,000 unique records, and the timeliness of IDs created for new film and episodic releases has improved as membership covers more and more of the commercial market. The diversity of records has grown from a focus on Level 1 title-level or parent IDs (“abstractions”) to encompass more Level 2 edits or versions of titles to accommodate various distribution needs. The migration to Level 3 manifestations is poised to explode as will be described later in this article.

The geographic reach of the registry has grown especially in last two years, and EIDR membership is now 20 percent companies outside the U.S., and two of the three largest catalog match and registration efforts in the past year originated in Europe. EIDR also has launched active Asian outreach, visiting Japan in December 2015 (along with Japan based executives from members Google, Sony, and Rovi) and planning another recruiting visit in mid-2016.

EIDR first emerged as an organizing factor within the title management systems of the major Hollywood studios. By 2015, it has been standard practice to create EIDR IDs for all film and television productions. The achievement of coverage of the universe of commercially viable content has yielded some interesting internal applications.

For example, Sony Pictures Entertainment recently spoke about an internal use case to support the business analysis leading to greenlighting decisions for new features. In such analysis, comparable films are analyzed to help predict the likely return on investment. To obtain a complete picture of competitive title performance, data from multiple sources covering multiple territories and distribution channels must be collated. This requires significant manual effort.

Sony analysts leveraged EIDR identifiers, and the existence of Alternate IDs within EIDR Records, to link data from multiple sources. Sony MPM IDs were used to retrieve previously matched IMDb IDs from EIDR-linked records. Rovi IDs could be used to match additional Sony MPM and EIDR records, pulling in even more IMDb IDs. EIDR’s matched Flixster IDs were used to pull Tomatometer ratings via the Rotten Tomatoes API. It is worth noting that several studios are customers of international ratings service aggregators. Those services have begun to use EIDR to help normalize ratings across multiple rating services in multiple territories.

At Warner Bros., the achievement of wide content coverage of EIDR IDs has enabled the studio to begin work on integrating EIDR into different internal tracking and management systems. EIDR is being integrated into Warner Bros.’ digital asset repository, as well as the company’s Metadata Service Bureau for master data, and the company’s DEPOT system for Digital Content Publishing, which supports UltraViolet, SuperTicket, Digital Copy 2.0, and eScreeners. In terms of digital distribution, EIDR is being integrated into digital asset management (DAM) systems, media asset management (MAM) systems, content ordering and workflow management portals, and the client avails system. Warner is also leveraging EIDR in financial systems and business-to-business portals.

EIDR has also surfaced in rights tracking products from EIDR members RSG Media and FilmTrack. Last year, FilmTrack unveiled a new integration with EIDR allowing Film- Track users easy access to EIDR’s unique content identifier system for movie and television assets. With the push of a button, FilmTrack users can now auto-populate an EIDR number into their StarCM Content Manager, which captures all metadata associated with a project, including title, genre, cast, crew, and hundreds of related attributes defining the technical and artistic nature of the film.

RSG Media adapted IBM’s digital innovation platform for IBM Cloud for performance analytics on networks’ media use.

The transition to the Bluemix product allows for the mass collection and analysis of structured and unstructured data sets from all linear, on demand, and digital media platforms. This includes networks’ revenues and costs, content rights, programming schedules, promotional placements, advertisements, social media activity, and a plethora of other industry data sources including EIDR, Nielsen and SNL Kagan to name a few.

This has enabled networks to optimize media planning and return on investment from all platforms including their use of programming, promos and advertising.

Warner Bros.’ use of EIDR in the client avails systems mentioned above provides synergy with some of its online retail partners, who also derive benefit. EIDR now contributes to a more efficient digital home entertainment supply chain, demonstrated by Google and Microsoft.

In a 2013 M&E Journal article, EIDR reported on a study of the Warner Bros. – Microsoft workflow and identified savings of hundreds of hours in manual matching and quality assurance (QA) efforts in just a single business deal for one pair of business partners. Multiplied by several partners and dozens of business deals, this amounts to significant cost savings.

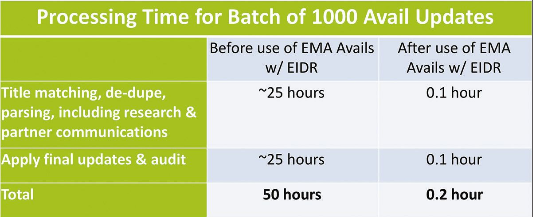

More recently, Google conducted an internal study and found dramatic reductions in processing time for a batch of avail updates.

Again, multiplied across tens of thousands avails, and hundreds of content partners, this effort pays for EIDR membership and effort many times over.

For both of these cases, in addition to cost savings, there are clear benefits through greater automation in time-to-market improvements, getting avails in front of consumers sooner and leading to earlier realization of revenues.

In summary, the past and present of EIDR has set the stage for some intriguing future growth paths enabled by technology breakthroughs and new business models.

IP transport accelerates

The transition to IP transport across all broadcast, MVPD, and digital supply chains continues to gain momentum.

Next generation standards and technologies are specifying EIDR as a standard content identifier: MPEG DASH, ATSC 3.0, adaptive bit-rate streaming, and the Interoperable Master Format among others.

Cable companies are in the midst of their IP transition. Comcast has introduced its X1 platform across much of its footprint, and its backbone delivery networks are already largely IP-based. IP standards in turn deliver on the long-promised ability to better target advertising in cable video-on-demand platforms.

Led by Comcast, the new standard SCTE 214 shows how to use SCTE 35 for client-side signaling of ad insertion points.

Further, the DASH Industry Forum has subsequently adopted the guidelines regarding the use of SCTE 35. Not only is SCTE 35 called out as a signaling method by DASH-IF, but EIDR is explicitly named as the “preferred scheme” for content identification. And so EIDR is built into an architecture module that will feed into the Comcast-owned FreeWheel cross-platform ad delivery platform, leading to better targeting of ads and enabling better ratings measurement.

Better ad targeting and better ratings measurement are both among the business goals of parts of the next generation ATSC 3.0 standards as well. Alongside physical layer upgrades to support IP transport to both fixed and mobile devices and to provide for UHD services, ATSC 3.0 candidate standards reference EIDR in several areas.

ATSC 3.0’s Watermark Payload document references EIDR in order to transmit program information within the physical layer stream. Verance and other EIDR member companies have already demonstrated proofs of concept embedding the binary version of EIDR, with its smaller payload, into an audio watermark. ATSC 3.0’s Usage Reporting Standard allows for a ContentID element that may include an EIDR ID or an Ad-ID, EIDR’s domain specific metadata partner.

Both of these elements support a recent joint release from ATSC and the Television Advertising Bureau of guidelines and best practices for the successful adoption and implementation of programmatic buying and selling of broadcast linear TV advertising. The document calls for a common, open application program interface (API) in the ad buying and selling ecosystems, and recommends, “the creative workflow, including registration with third party entities (such as Ad-ID or EIDR) and seller creative approval, should be supported by the API.”

One final technology on the horizon is the SMPTE Interoperable File Format (IMF). IMF defines a single, interchangeable master file format, which can be used for flexible versioning and automation for downstream file transcoding. EIDR’s Level 3 Manifestations category is likely the appropriate ID type for an IMF, and IMF adoption by Netflix and other EIDR members will likely make Level 3 the fastest growing EIDR ID type. By associating an EIDR Identifier with a “composition,” the EIDR becomes available as the composition is transformed, allowing the work to be identified from its origin on to downstream distribution channels ranging from IPTV to mobile platforms to digital cinema.

And speaking of digital cinema brings us full circle back to the major Hollywood studios who drove the creation of EIDR for some very near term theatrical needs, but helped provide the basis for a flexible identifier to support the ever burgeoning array of business and technical vehicles to get creative content to customers.

Click here to translate this article

Click here to download the complete .PDF version of this article

Click here to download the entire Spring 2016 M&E Journal